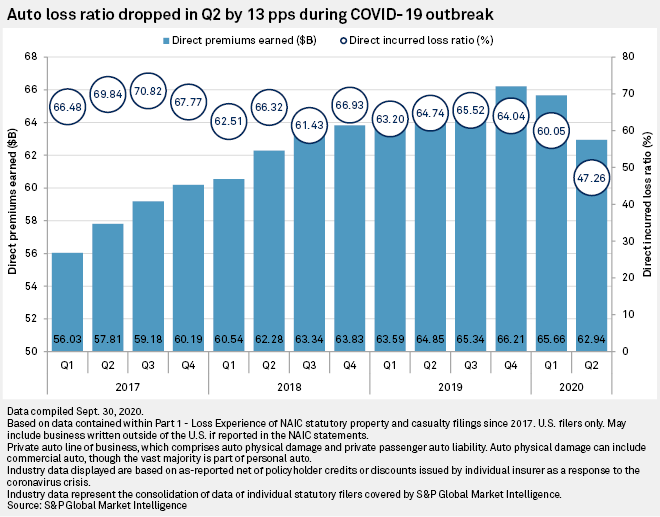

A significant reduction in driving activity during the spring led to a sharp drop in private auto insurance claims and allowed the industry to post a historically low loss ratio in the second quarter.

The industry's loss ratio in the second quarter was just 47.3%. S&P Global Market Intelligence analyzed quarterly loss ratios in the private auto segment since the first quarter of 2001; the next-lowest loss ratio in a three-month period was 56.3%, recorded in the third quarter of 2006.

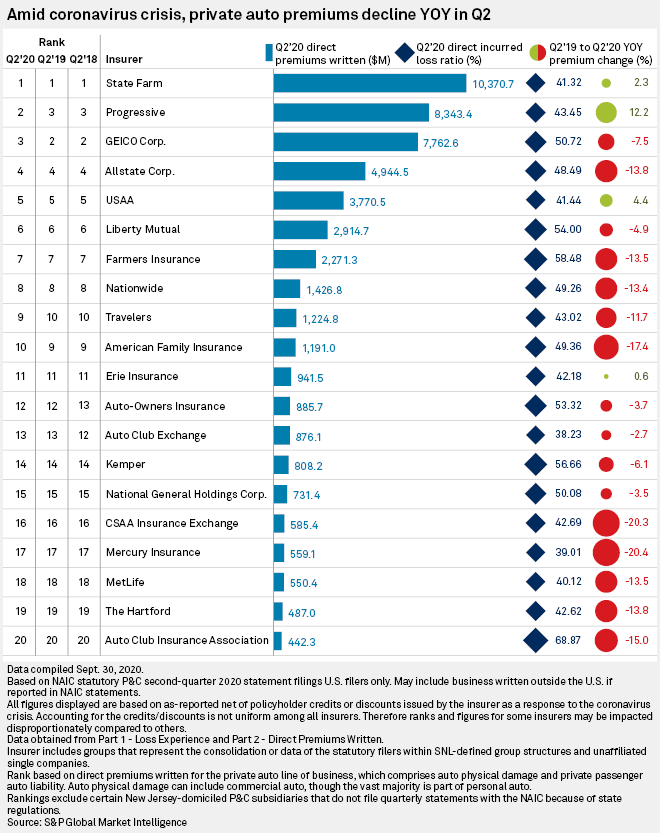

Along with the loss ratio improvement, the industry saw direct premiums written fall 4.5% during the quarter. The premium reduction includes discounts and credits offered by many large U.S. private auto insurers to their auto and motorcycle policyholders as fewer miles were driven when the COVID-19 pandemic first took hold in the spring.

Insurers issued benefits either by reducing premiums, providing renewal discounts or offering dividends to policyholders. A previous S&P Global Market Intelligence analysis reviewed the effects of these accounting changes in depth. It shows that of the five largest companies, State Farm Mutual Automobile Insurance Co. and United Services Automobile Association accounted for the bulk of their refunds as dividends. Allstate Corp. and GEICO Corp. directly reduced premiums, which also affects their loss ratios. Progressive Corp. added the discounts to its underwriting expenses.

Market conditions in the second quarter benefited State Farm as much as any large insurer. It recorded the lowest loss ratio among the top 15 private auto carriers at 41.3%. State Farm, the largest private auto insurer in the U.S., recorded $10.37 billion in direct written premiums in the second quarter, up 2.3% from the prior-year period.

GEICO provided a 15% premium credit for new and renewal customers in light of the pandemic. The insurer budgeted $2.5 billion for reductions to written premiums on its auto businesses. The credits led to a 7.5% year-over-year decline in direct premiums written for the quarter.

GEICO also deferred its reduction to earned premium to subsequent quarters. This led to GEICO reporting an earned premium increase of 1.8% during the three months that ended on June 30.

Progressive subsidiaries offered 20% credits to eligible customers for two months in April and May. The insurer's loss ratio was below the industry average at 43.5%, compared to 60.8% in the second quarter of 2019.

Even though they offered hefty discounts and credits, private auto insurers still came out ahead on the deal in the second quarter due to the sharp decline in losses. Earned premiums dropped by less than $2 billion, while incurred losses decreased by more than $10 billion compared to the first quarter. Most of the discount programs have been discontinued by the largest insurers as drivers got back on the road.

US private auto loss ratio falls to historic low in Q2 amid pandemic - S&P Global

Read More

Bagikan Berita Ini

0 Response to "US private auto loss ratio falls to historic low in Q2 amid pandemic - S&P Global"

Post a Comment