Mike Calvert Toyota general manager Mike Gorbet’s assessment of his dealership’s inventory levels early this month defied belief.

“Pre-COVID, we’d probably carry 400 new vehicles in stock. Right now, I have two,” said Gorbet.

“Two-hundred?” Gorbet was asked. “No, two,” Gorbet responded. “One’s a Highlander, and one’s a Camry.”

Serving the most populous city in the second most vehicle-heavy state in the country has always kept Houston auto dealers hopping, but today they are scrambling more than ever in a pandemic-induced reversal of fortune. After years of beating the bushes to find customers to buy, they are instead searching high and low for cars to sell.

Car dealers have traditionally offered promotions and discounts over the long President’s Day weekend, but this year they are wrestling with shortages of new vehicles as a stubborn shortage of computer chips and other parts slows production at the nation’s automakers. With fewer vehicles to show and sell, dealers have had to adapt, redeploying staff to hunt down new cars and increasing their focus on buying and selling used vehicles to offer customers the option of driving a car off the lot.

Gorbet estimated that his dealership will sell about 280 new vehicles this month - down from about 400 before the pandemic. About 95 percent of the vehicles Toyota delivers to Mike Calvert Toyota are pre-sold and “never spend the night” on the lot, Gorbet said.

Instead of showing cars and taking customers out for test drives, salespeople are scrolling through computer screens as they try to match buyers’ wishes with the dealers’ inventory pipeline. Delivery of a new vehicle after it’s ordered can take anywhere from two days to six weeks.

Meanwhile, for those willing to wait for new vehicles, dealers are preaching patience. Doggett Ford owner Leslie Doggett said his dealership’s new-car inventory is down to about 200 from what was typically about 1,000. The shortage has boosted the number of pre-orders as well.

“If we order an F-150, we typically bid 10 weeks. If it’s spec’ed with items in short supply, 14 weeks,” said Doggett, in reference to the best-selling Ford pickup truck. “We’ve found that the vast majority of customers are pretty well-informed, and they understand that there are some pretty severe supply chain issues. The overwhelming majority come in with their fingers crossed that you might have the vehicle they want in stock, and are pretty excited when you do.”

Car sales specialist David Claar talks to a customer who is interested to trade in his car and buy a new vehicle Thursday, Jan. 20, 2022, at Doggett Ford in Houston. Claar said he works with customers over the phone and on the computer most of the time. He kept a spreadsheet of customers and their desired vehicles, and he would notify them if something comes up at the dealership.

Yi-Chin Lee, Houston Chronicle / Staff photographer

Car sales specialist Javier Medina Jr., left, works on details with sales manager Victor Ruvalcaba to help customer Pedro Gonzalez building a Super Duty F-350 Thursday, Jan. 20, 2022, at Doggett Ford in Houston. Gonzalez wanted to get a truck for his construction company as soon as possible, but Medina said the orders are backed for at least six months.

Yi-Chin Lee, Houston Chronicle / Staff photographerYi-Chin Lee, Houston Chronicle / Staff photographer

Worldwide shortage

Houston dealers are contending with a worldwide vehicle shortage that’s more than two years in the making. Starting with the 2019 strike at General Motors, the automotive industry has been hit with a series of events that have reduced production, including a March 2021 fire at a Renesas Electronics factory in Japan that destroyed computer chips slated for new vehicles, said Jessica Caldwell, executive director of insights at Edmunds.com, an automotive industry analyst in Santa Monica, Calif.

The COVID-19 pandemic forced automakers to reduce both orders for parts and vehicle production in early 2020, when the economy all but ground to a halt. The industry has yet to recover from the initial disruptions as subsequent COVID outbreaks forced shutdowns of auto factories and parts manufacturers. As a result, U.S. new-vehicle inventory is about 25 percent of what it was prior to COVID, according to Caldwell.

“At the beginning of the pandemic, automakers stopped production. Those [computer] chip orders went to other industries, like computers and gaming, and the automakers weren’t able to get those orders back,” she added. “The only time we previously saw inventory levels fall was from the [2011] Japanese tsunami, and that was just for a few brands, but not across the board.”

The component shortage has put a crimp on vehicle sales across the country. U.S. consumers bought about 14.9 million new light-duty vehicles last year, well below that the five-year average of 17.3 million vehicles between 2015 and 2019, according to Atlanta-based Cox Automotive, the parent company of such automotive-industry brands as Kelley Blue Book and Autotrader.com.

On HoustonChronicle.com: Chip shortage still muffling new vehicle sales in Houston

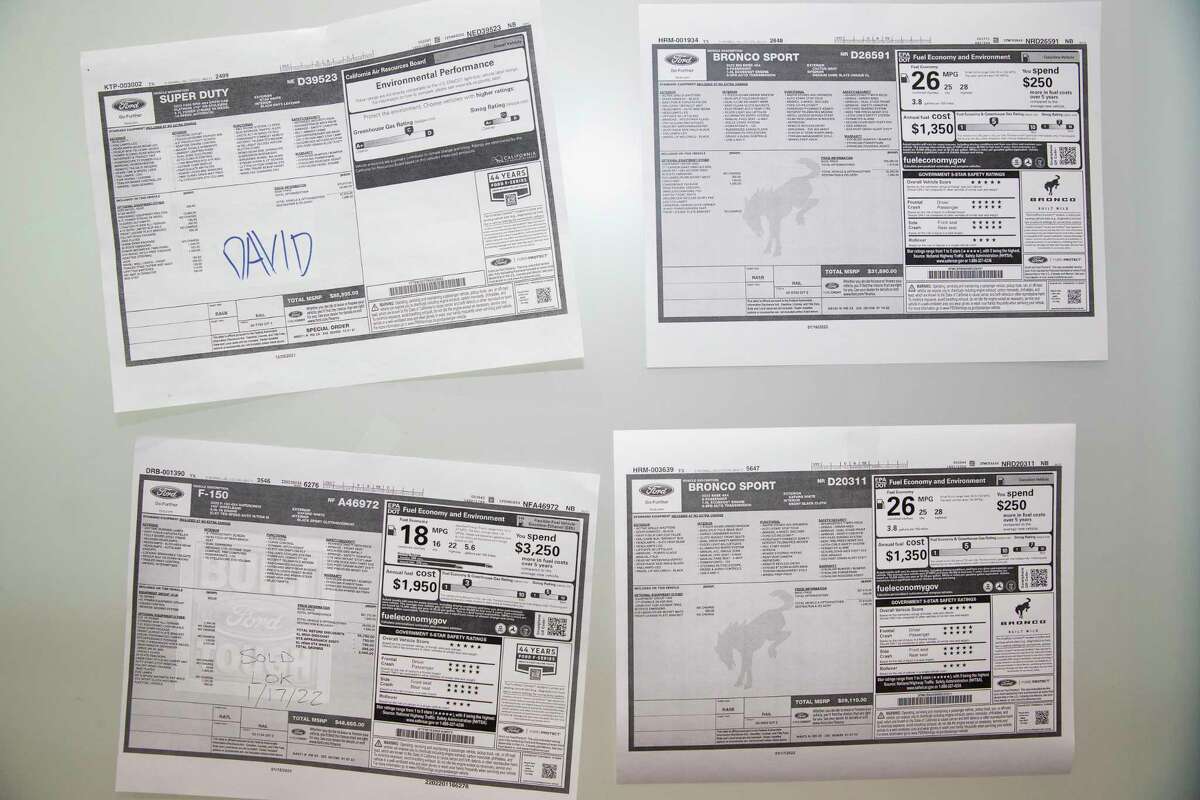

Window stickers for vehicles that will be delivered are hung on the glass wall at the dealership Thursday, Jan. 20, 2022, at Doggett Ford in Houston. Sales specialist David Claar said half of the vehicles on the glass door would be sold before they are delivered.

Yi-Chin Lee, Houston Chronicle / Staff photographerThere are few signs the situation is easing. New vehicle sales were projected to fall more than 8 percent last month, according to the consumer-survey firm J.D. Power and LMC Automotive, an analytics company based in Detroit.

Prices rose to an average of about $45,000 last month, up more than 20 percent from $37,165 a year earlier, according to the report. The average time a new vehicle spent on a dealer lot plummeted to 19 days from 51 days a year earlier

But higher prices have allowed car dealers to make more money as they sell fewer cars. Houston-based Group 1 Automotive reported earlier this month that it nearly doubled its annual profit to a record $552 million last year from $286 million, even as the volume of new car sales fell 3.5 percent. Revenues jumped 27 percent to $13.5 billion from $10.6 billion in 2020.

Houston dealers have attempted to improve their bottom lines by both selling new vehicles at sticker price or higher, and by selling more used cars. Doggett, who said that his sales volume was up from last year’s, noted that most new vehicles are selling for at least sticker price because prospective customers are aware of supply shortages.

Gorbet, who’s worked in the auto sales industry for more than three decades, said that average new-vehicle pricing was up, but his dealership eschewed so-called “market adjustments,” in which dealers add as much as $10,000 to the sticker price if they think they have a willing buyer.

“We don’t do that,” Gorbet said. “If you don’t take care of your customers now, when they need you, why should they come back later when inventory is high?”

Car sales specialist Javier Medina Jr., left, works on details with sales manager Victor Ruvalcaba to help customer Pedro Gonzalez building a Super Duty F-350 Thursday, Jan. 20, 2022, at Doggett Ford in Houston. Gonzalez wanted to get a truck for his construction company as soon as possible, but Medina said the orders are backed for at least six months.

Yi-Chin Lee, Houston Chronicle / Staff photographer

Car sales specialist Kelton Rembert answers his phone at the dealership Thursday, Jan. 20, 2022, at Doggett Ford in Houston.

Yi-Chin Lee, Houston Chronicle / Staff photographer

Car sales specialist David Claar texts a customer, whom he has been working with for three months, about a F-150 truck that he might be interested and will be available at the dealership Thursday, Jan. 20, 2022, at Doggett Ford in Houston. The dealership puts window stickers of vehicles that will be delivered to the shop on the glass wall. Claar said half of the vehicles on the glass door would be sold before they are delivered.

Yi-Chin Lee, Houston Chronicle / Staff photographer

Car sales specialist Javier Medina Jr. helps Pedro Gonzalez building a Super Duty F-350 Thursday, Jan. 20, 2022, at Doggett Ford in Houston. Gonzalez wanted to get a truck for his construction company as soon as possible, but Medina said the orders are backed for at least six months.

Yi-Chin Lee, Houston Chronicle / Staff photographerYi-Chin Lee, Houston Chronicle / Staff photographer

Getting used

Gorbet estimated that about half his sales staff is focusing on buying used cars, and that the dealership has boosted its used-car inventory to almost 400 cars from the typical 325 and 350 used vehicles. He added that a used car that etched about $20,000 last year could now sell for about $25,000.

Doggett said that his used-car prices have risen even more sharply, up about 37 percent from a year ago. As a result, Doggett Ford’s used-vehicles account or more than half of the dealership’s sales volume, up from what was typically about a third.

On HoustonChronicle.com: 'Truck after truck after truck': Port Houston supply chain struggling to meet demand

“The other side of the coin is that those prices can come down just as quick,” said Doggett, who said his dealership was carrying about 200 used vehicles on its lot. “As a dealer, you’ve got to be very careful that you don’t buy all that you can buy. Those prices can come down in a month.”

Caldwell, the Edmunds analyst, estimated that the global vehicle inventory should gradually improve during the next few months as the factories catch up on production. Still, Gorbet expects inventories to remain tight as demand for new cars remains strong.

“I don’t think you’ll see more ground stock this year,” he added. “Toyota is catching up, but we’re selling the cars as fast as they’ll send them.”

Global vehicle shortage flips game for Houston auto dealers who can't find cars to sell - Houston Chronicle

Read More

Bagikan Berita Ini

0 Response to "Global vehicle shortage flips game for Houston auto dealers who can't find cars to sell - Houston Chronicle"

Post a Comment