In this week’s installment of our Four Pillars of Online Sales Control series, we tackle Pillar Three: Pricing & Promotional Strategy. We will address:

- How pricing and promotional actions fuel online disruption and harm to brand value;

- The pros and cons of common pricing policies; and

- Tactics for mitigating a glut of unauthorized sales in the wake of promotional activity.

As we discussed in our first post, brands in the online marketplace era should first level-set their channel management strategy to mitigate online disruption and best position themselves to be able to govern the online marketplace channel. Then, as explained in our second post, brands must have the requisite foundation and processes to enable efficient, effective and legally grounded enforcement against unauthorized sellers. Next, brands must carefully align their pricing and promotional strategies so as to prevent profitable growth across the online marketplace and broader omni-landscape.

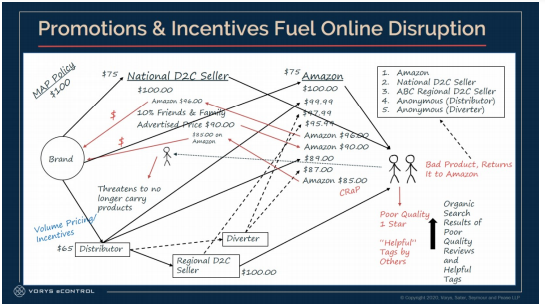

Companies’ pricing and promotional strategies are a common cause of uncontrolled online sales – fueling unauthorized selling, channel conflict and degraded brand value. For example, pricing differentials between markets or channels can facilitate diversion as products intended for one market are diverted into another. Likewise, large retail margins allow for easy money to be made on online marketplaces. Volume-based discount structures are another common issue, which incentivize distributors to purchase at levels beyond which natural demand supports. In terms of promotions, BOGO deals, unlimited quantities and compounded couponing can all cause significant unauthorized sales issues. Volume-based discount structures are another common issue, which incentivize distributors to purchase at levels beyond which natural demand supports. Brands should give careful thought to their wholesale pricing, trade spend and incentive stacks. The graphic below demonstrates how quickly an outdated pricing and promotional strategy can cause brand harm in the Amazon age:

MAP Policies – A Potentially Useful Tool, But Often Not a Viable Stand-Alone Strategy

Many U.S. brands consider implementing a pricing policy like MAP in an effort to reign in online chaos. Simply stated, MAP policies are unilateral policies issued by the brand that state the minimum price at which the manufacturer wants its products to be advertised. We hear from many brands that are confused about whether a MAP (or similar) policy is right for their brand and what the pros and cons are of each. The below chart provides a summary of key considerations when determining which pricing policy is best for your business. You can also access our whitepaper: The Winning Strategy for MAP Success and Long Term Brand Value in the eCommerce Market.

MAP policies are only as effective as a manufacturer’s willingness to enforce them, and they need to be enforced uniformly against customers big and small. Thus, MAP policies often present practical commercial challenges for brands, and – in and of themselves – cannot solve online sales disruption issues. Here are five common points of failure companies experience when relying on MAP alone to solve their challenges:

1. You sell 1P to Amazon and are subject to its pricing algorithm.

Brands that sell 1P to Amazon are subject to Amazon’s dynamic pricing algorithm, which does not follow your stated MAP policy. Amazon’s pricing model is designed to keep advertised prices as low as possible. As such, Amazon pricing is automatically adjusted in the event unauthorized 3P sellers or another retailer advertise below MAP. Given Amazon’s massive visibility, other retailers are likely to take notice and either complain to you or follow it down, which can quickly drag all major sales outlets below MAP. These dynamics can make it challenging for 1P brands to maintain strong MAP compliance levels.

2. You sell through two-step distribution and lack control over downstream resellers.

Brands that sell to distributors that, in turn, sell to retailers can find MAP success elusive. This is because these brands often lack downstream control over their distributors’ customers, including a mechanism for their MAP policies to reach these retailers. In addition, many brands that sell through this model do not have procedures for qualifying or authorizing online sales. Thus, brands are often quickly confronted with numerous downstream resellers listing the brands’ products for sale wherever they want and advertising products below MAP in an effort to win sales. This puts significant pressure on brands’ direct retailers, which are then forced to break MAP to remain competitive.

3. You have unauthorized online sellers and lack the foundation necessary to stop them.

One of the most common misunderstandings that brands make is believing their MAP policies apply to unauthorized 3P sellers. They do not. MAP policies are ineffective against unauthorized 3P sellers because the brand typically does not know who these sellers are or where they are getting product. The brand has no ability to stop the unauthorized sellers’ supply, and these sellers continue advertising products below MAP, disrupting the brands’ entire business. Brands need to establish a specific legal foundation (having nothing to do with MAP) to stop unauthorized sellers – without which these sellers will continue making MAP success virtually impossible. We covered this in our recent post on unauthorized sellers here.

4. Your sales teams are undermining your MAP.

In many companies, sales teams may tell customers that they “don’t need to follow the MAP policy” or that the “company will look the other way” if the retailer does not adhere to MAP. In addition to potentially creating legal risk, these types of communications can undermine the success of the entire MAP program. Companies must ensure that all teams are fully aligned on the importance of MAP and that no personnel are knowingly or unknowingly undercutting the company’s efforts.

5. You are unwilling to enforce your MAP policy.

Many companies simply find themselves unwilling to enforce their MAP policy. A MAP policy is only as effective as a company’s willingness to enforce it against any and all violating retailers. Companies must be prepared to stop supplying offending retailers, otherwise the integrity of the entire program will be damaged. If companies are not willing to do this, they are better served to pursue a different strategy altogether to protect and grow their brand equity.

When brands are able to properly align internally on their commitment to MAP, design a MAP policy appropriate for their unique commercial circumstances, and enforce their policy consistently, MAP and similar policies can be a useful tool. Properly executed, MAP policies can help to incentivize strong distributors and retailers to invest in brands, educated staff and the selling environment. This strengthens brand equity and further incentivizes manufacturers to innovate and invest in new, quality products.

Incentive & Promotional Practices: Avoid Adding Fuel to the Fire.

Many brands offer some form of incentive to channel customers or foreign distributors and/or end user promotions. In today’s market, however, these practices afford buying opportunities for diverters who (1) quickly sell products on Amazon and other marketplaces once the promotional periods have run, or (2) who ship products back into the US. These offers are typically made below the brand’s MAP price and take sales away from brands’ authorized sellers, causing Amazon and other retailers to reduce their offers, and this cycle perpetuates – becoming known as the “race to the bottom”.

The reality today is that brand’s must give careful thought to the ripple effects of incentive and promotional activity, lest they be inadvertently fueling never-ending waves of unauthorized sellers. The following practices are common root causes of unauthorized sales activity and should be carefully managed to ensure that they do not disrupt broader initiatives around MAP compliance, authorized sales growth and overall brand equity:

- Pricing Differentials: Pricing differentials between markets or channels can facilitate product diversion as products intended for one market or channel are diverted into another. Indeed, many brands – whether they know it or not – are underwriting the business of many resellers, causing themselves significant harm. This issue is often pronounced in the context of international sales, where brands may sell products in some countries at lower prices only to find those products resold by unauthorized sellers on Amazon or other marketplaces. Brands should carefully scrutinize for both legal and diversion risk in those markets or channels where such differentials may exist and determine if alternative structures can be implemented.

- Excessive Retail Margins: Brands should pay their authorized sellers fairly for the work they do, but must be careful to avoid overpaying. When retail margins are too high, especially when the brand lacks sufficient control over its other channels, unauthorized sellers are often able to acquire product and resell it on marketplaces. Because these sellers make no investment whatsoever in the brand, they are content to trade at margins far below those at which invested channel partners are able to compete. Brands can mitigate these issues by:

- adjusting channel pricing, trade spend and/or incentive stacks

- lowering MSRP or MAP

- or, in some instances even implementing maximum resale prices, particularly on aging products

- Volume Discounts and Incentives: Brands frequently overcompensate distributors relative to their cost to serve volume-based discount structures. Additionally, brands often provide growth rebate programs that provide payments based on achievement of revenue targets, which further enrich wholesale margins. Such incentives, independently and collectively, incentivize distributors to purchase at levels beyond that which natural demand supports. This overstock becomes the primary source of diversion for many brands. Given their better initial margin levels, distributors can “dump” inventory and still make an attractive return. These practices are especially difficult to detect with larger distributors where incremental purchase increases escape scrutiny in the context of traditionally large ordering patterns. Worse yet, distributors are increasingly establishing their own retail storefronts on Amazon and other marketplaces, which given their margin structure, can foster huge disruption for the brand. In addition to scrutinizing these programs carefully, brands can use them as “carrots or sticks”, depending on the brand’s strength, contingent on the receipt of verified distributor sell-through data.

- In Store Promotions: Promotions are also a frequent cause of product diversion, especially when unlimited quantities and/or compounded couponing are at play. The ability to “game” promotions should be carefully scrutinized as promotions are being designed. Brands should also ensure they have good perspective on promotions that are currently being run by other areas of their business or within the channel itself to ensure they aren’t inadvertently providing additional economic incentives that aren’t necessary to drive demand. Additionally, brands should carefully structure and tailor their promotional programs to the target audience. For example, they should ensure that two-tier channel promotions are carefully directed toward the appropriate retail or dealer sales channel and that guardrails are in place for subsequent resale on marketplaces. Further, to mitigate these issues, brands should (1) ensure that consumer promotions have quantity purchase limits; (2) have a deliberate strategy regarding compounded couponing; and (3) only pay sales channels for the promotion based on proof of sale.

- International Rerouting: Brands often sell products to distributors for resale abroad. These products are often sold at lower prices than U.S. products in alignment with the economic dynamics of the intended foreign market. Such pricing differentials can present an alternative arbitrage opportunity, with such products never leaving port – or even traveling around the world and back – and ending up on Amazon. Brands should carefully evaluate and monitor their international distributors to ensure that products are being sold where intended. If this is not possible, brands can look into regional or national product segmentation or variation strategies so that it is clear that the products at issue were manufactured for foreign markets, or look into means of enforcement through customs. Additionally, making incentives contingent on export confirmation and/or sell through reporting can be a useful tactic to mitigate harmful behavior.

In Summary – Don’t Shoot Yourself in the Foot

Brands today need to carefully consider the online fallout caused by traditional pricing and promotional programs. When these initiatives are not carefully managed, they can quickly undo the brand’s channel management strategy, breed unauthorized sellers and cause long-term harm to brand equity.

Pricing Policies & Promotional Strategy: The Third Pillar of Online Sales Control - Lexology

Read More

Bagikan Berita Ini

0 Response to "Pricing Policies & Promotional Strategy: The Third Pillar of Online Sales Control - Lexology"

Post a Comment